简介

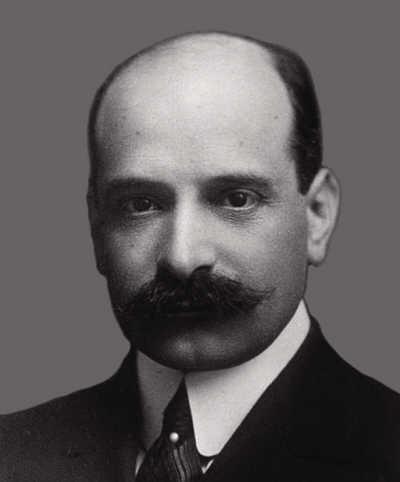

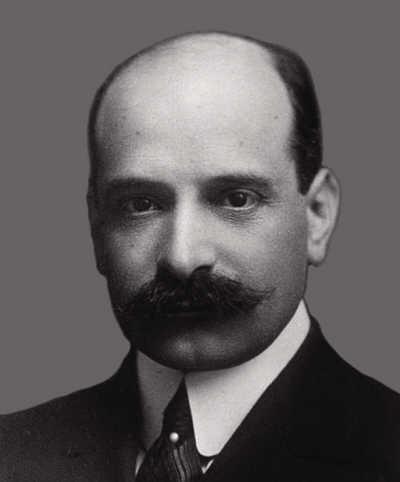

保罗·沃伯格

保罗·沃伯格(Paul Warburg),德国犹太移民,1901年到美国,库恩雷波公司(KuhnLoebandCompany)的高级合伙人,美联储的总设计师,第一任美联储董事。1902年,保罗和费里克斯兄弟从德国法兰克福移民到美国。出身于银行世家的两兄弟对银行业务十分精通,尤其是保罗,堪称当时的金融顶尖高手。罗斯柴尔德非常看重保罗的天分,特意从欧洲战略联盟的沃伯格家族银行(M. M. Warburg and Co.)将两兄弟抽调到急需人才的美国战线上。此时,罗斯柴尔德家族在美国推行私有中央银行的计划已近百年,始终起起伏伏没有最终得手。这一次,保罗将承担主攻任务。

在抵达美国不久,保罗加盟先头部队雅各布·希夫的库恩雷波公司,并娶了希夫妻妹的女儿,费里克斯则娶了希夫的女儿。

西奥多·罗斯福和威尔逊总统两朝的金融顾问加里森(Colonel Ely Garrison)指出:“在奥尔德里奇计划在全国招致愤恨和反对的情况下,是保罗·沃伯格先生把《美联储法案》重新组合起来的。这两份计划背后的天才智慧都来源于伦敦的阿尔弗雷德·罗斯柴尔德。”

难题

“美联储的总设计师”保罗·沃伯格

保罗把最后的版本改为“董事会成员由美国总统任命”,但是董事会的真正功能由联邦咨询委员会所控制,联邦咨询委员会与董事会定期开会“讨论”工作。联邦咨询委员会成员将由12家联邦储备银行的董事决定,这一点被有意地向公众隐瞒了。另一个保罗要应付的难题是,如何隐藏纽约的银行家将主导美联储这个事实。19世纪以来,美国中西部广大中小商人、农场主饱受银行危机的浩劫,对东部银行家深恶痛绝,这些地区的议员不可能支持纽约银行家占主导的中央银行。保罗为此设计了一套由12家美联储地区银行构成整个系统的天才解决方案。在银行圈子之外,很少有人明白,在美国货币和信贷发放高度集中于纽约地区这一基本前提下,提议建立各地区联储银行,只不过是给人造成中央银行的业务并没有集中在纽约的假象罢了。

还有一个体现保罗深谋远虑之处的就是将美联储总部设在政治首都华盛顿,而有意远离它真正接受指令的金融之都纽约,以进一步分散公众对纽约银行家的顾虑。

保罗的第四个困扰是如何产生12家美联储地区银行的管理人员,奥尔德里奇的国会经验终于派上了用场。他指出中西部的议员普遍对纽约银行家有敌意,为了避免失控现象,所有地区银行的董事应该由总统任命,而不要由国会插手。但是这造成了一个法律漏洞,《宪法》第一章第八节明确规定由国会负责发行管理货币,将国会排除在外,意味着美联储从一开始就违背了《宪法》。后来这一点果然成了很多议员攻击美联储的靶子。

在经过这一番颇具匠心的安排以后,该法案俨然以模拟美国宪法分权与制衡的面目出现。总统任命,国会审核,独立人士任董事,银行家做顾问,真是滴水不漏的设计!

英文介绍

Paul Moritz Warburg (August 10, 1868 — January 24, 1932) was a German-American banker and early advocate of the U.S Federal Reserve system.

Warburg was born in Hamburg, Germany, to a successful Jewish banking family. His parents were Moritz and Charlotte (Esther) Warburg. After graduating from the Realgymnasium in Hamburg in 1886 he entered the employ of Simon Hauer, a Hamburg importer and exporter, to learn the fundamentals of business practice. He similarly worked for Samuel Montague & Company, bankers, in London in 1889-90, the the Banque Russe pour le Commerce Etranger in Paris in 1890-91.

In 1891 Warburg entered the office of the family banking firm of M.M. Warburg & Company, which had been founded in 1798 by his great-grandfather. He interrupted work there to undertake a world tour during the winter of 1891-92. Warburg was admitted to a partnership in the family firm in 1895.

On October 1, 1895, Warburg was married in New York City to Nina J. Loeb, daughter of Solomon Loeb, founder of the New York investment firm of Kuhn, Loeb & Company. The Warbugs were the parents of a son, James Paul Warburg, and a daughter, Dr. Bettina Warburg.

Although a major factor in German finance, after frequent business trips to New York Warburg settled there in 1902 as a partner in Kuhn, Loeb & Company where the influential Jacob Schiff, his wife's brother-in-law, was senior partner. Warburg remained a partner in the family firm in Hamburg, but he became a naturalized American citizen in 1911. He was a member of Temple Emanu-El in New York City.

Warburg was elected a director of Wells Fargo & Company in February 1910. He resigned in September 1914 following his appointment to the Federal Reserve Board, and Jacob Schiff was elected to his seat on the Wells Fargo board.

Paul Warburg became known as a persuasive advocate of central banking in America, in 1907 publishing the pamphlets "Defects and Needs of Our Banking System" and "A Plan for A Modified Central Bank". His efforts were successful in 1913 with the founding of the Federal Reserve System. He was appointed a member of the first Federal Reserve Board by President Woodrow Wilson, serving until 1918.

In 1919 he founded and became first chairman of the American Acceptance Council. He organized and became the first chairman of the International Acceptance Bank of New York in 1921. International Acceptance was acquired by the Bank of the Manhattan Company in 1929, with Warburg becoming chairman of the combined organization.

He became a director of the Council on Foreign Relations at its founding in 1921, remaining on the board until his death. From 1921 to 1926 Warburg was a member of the advisory council of Federal Reserve Board, serving as president of the advisory council in 1924-26. He was also a trustee of the Institute of Economics, founded in 1922; when it was merged into the Brookings Institution in 1927, he became a trustee of the latter, serving until his death.

Warburg was notable on March 8, 1929, for warning of the disaster threatened by the wild stock speculation then rampant in the United States, foretelling the crash which occurred in October of that year.

He encouraged German-American cultural cooperation, helping found the Carl Schurz Memorial Foundation in 1930 and serving as its treasurer from May 1930 until his death. He also made substantial contributions to the Warburg Library in Hamburg, founded by his family; gave to Heidelberg Uiversity one of its halls, known as the American House; and he made generous donations to the Academy of Political Science in Berlin.

Paul Warburg died at his home in New York City on January 24, 1932. At the time of his death he was chairman of the Manhattan Company and a director of the Bank of Manhattan Trust Company, Farmers Loan and Trust Company of New York, First National Bank of Boston, Baltimore & Ohio Railroad, Union Pacific Railroad, Los Angeles & Salt Lake Railroad, Western Union Telegraph Company, American I.G. Chemical Company, Agfa Ansco Corporation, and Warburg & Company of Amsterdam.

The cartoon character, "Daddy" Oliver Warbucks in the Little Orphan Annie series, was purportedly inspired by the life and times of Paul Warburg. The Paul M. Warburg chair in Economics at Harvard University was named in his honour, a title which is currently held by Professor Robert J. Barro.

His son James Warburg (1896-1969) was a financial adviser to Franklin D. Roosevelt in the first years of his presidency.